Get the free form 428

Show details

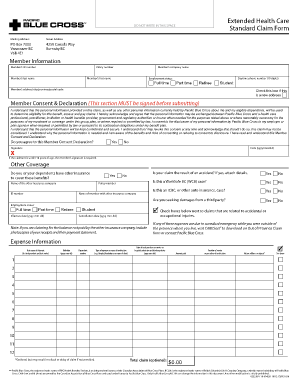

COMMUNICATION SERVICE AUTHORIZATION 1. AUTHORIZATION 3. CIRCUIT OR BILL NUMBER 2. AUTHORIZATION a. NUMBER b. DATE (YYYYMMDD) a. NUMBER b. DATE (YYYYMMDD) 4. FROM (Include ZIP Code) 5. SUBMIT BILLS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 428 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 428 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 428 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dd form 428. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out form 428

How to fill out form 428:

01

Start by obtaining a copy of form 428 from the appropriate source, such as a government website or local tax office.

02

Read the instructions provided with the form carefully to understand the requirements and ensure that you have all the necessary information and documents to complete it.

03

Begin by filling in your personal information, such as your name, address, and social security number, as required by the form.

04

Next, proceed to the sections of the form that pertain to your specific situation. This may include reporting income, deductions, credits, and any other relevant financial information.

05

Provide accurate and detailed information for each section, making sure to follow any specific guidelines or formatting instructions mentioned in the instructions.

06

Double-check all the information you have entered to ensure its accuracy and completeness. It is crucial to avoid any mistakes or omissions that could potentially lead to issues or delays in processing your form.

07

Sign and date the completed form as indicated, certifying that the information provided is true and accurate to the best of your knowledge.

08

Make a photocopy of the filled-out form and keep it for your records before submitting the original form to the designated authority.

Who needs form 428:

01

Individuals who earn income from self-employment or have business income may need to fill out form 428.

02

Form 428 is used in certain countries to report and calculate the taxable income for individuals who are self-employed or have business income.

03

It is typically required for individuals who operate as sole proprietors, freelancers, contractors, or small business owners.

04

Form 428 helps in calculating the tax liability for individuals engaged in self-employment or running a business, taking into account their income, deductions, credits, and other relevant financial information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 428?

Form 428 is a tax form used in Canada for individuals to calculate and report their provincial or territorial taxes owed. The specific name and content of this form may vary depending on the province or territory, as each jurisdiction has its own tax regulations. Generally, form 428 is used to determine the provincial or territorial tax payable based on an individual's income and other applicable factors.

Who is required to file form 428?

Form 428 is a tax form in Canada, required to be filed by individuals who are claiming a foreign tax credit.

How to fill out form 428?

Form 428 is the calculation worksheet for the Manitoba Family Tax Benefit and the Working Income Tax Benefit. Here are the steps to fill out this form:

1. Start by entering your personal information in Section A, including your name and social insurance number (SIN).

2. Move to Section B, where you will report your marital status and dependents. Enter the necessary details such as the number of dependents you have and their ages.

3. In Section C, indicate whether you or your spouse/common-law partner are eligible for or receive certain benefits like the Canada Child Benefit, Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit, or the Child Disability Benefit.

4. Section D is for reporting your and your spouse/common-law partner's income. Include all applicable income sources like employment, self-employment, rental income, pensions, etc. Fill in the corresponding boxes with the relevant values.

5. In Section E, calculate your Manitoba Family Tax Benefit and enter the amounts listed. The instructions on the form will guide you on how to calculate these values. Enter the calculated amounts in the appropriate boxes on the form.

6. Section F is for determining your Working Income Tax Benefit. Again, follow the instructions provided to calculate your eligibility and corresponding amounts. Enter the calculated values in the relevant boxes.

7. Once you have filled out all the necessary sections and calculated the appropriate amounts for both benefits, double-check all the information to ensure accuracy.

8. Finally, sign and date the form, and include your SIN again at the bottom.

Remember to keep a copy of the completed form for your records. You may also need to attach additional documentation or schedules as required for your specific situation. If you have any doubts or questions about completing Form 428, it is recommended to consult with a tax professional or contact the Canada Revenue Agency (CRA) for assistance.

What is the purpose of form 428?

Form 428 is a document used in Canada for reporting income from self-employment or professional activities. The purpose of this form is to report gross income, allowable expenses, and net income from self-employment or professional activities for tax purposes. It is used by individuals who are self-employed, such as freelancers, contractors, or small business owners, to calculate their taxable income and fulfill their taxation obligations. The form also helps the Canada Revenue Agency (CRA) in assessing the taxes owed and ensuring compliance with tax regulations.

What information must be reported on form 428?

Form 428 is used by individuals who are self-employed or have income from a business or a partnership and need to report their income and expenses. The following information needs to be reported on Form 428:

1. Personal information: This includes the individual's name, address, Social Insurance Number (SIN), and contact information.

2. Business income: All sources of income earned from self-employment or partnerships during the tax year should be reported. This includes gross sales or revenue received, as well as any income earned from services or products.

3. Business expenses: All legitimate business expenses incurred to earn income should be reported. This includes expenses related to advertising, office rent, utilities, cost of goods sold, professional fees, salaries, wages, property tax, insurance premiums, and more.

4. Capital cost allowance (CCA): If the individual has acquired business assets during the tax year, they can claim CCA, which is the depreciation of those assets over time. The details of the assets and their purchase prices should be reported.

5. Net income: The total income earned from the business minus the expenses and CCA claimed will give the net income. This amount is used as a basis for calculating taxes owed.

6. Filing status: The individual must indicate their filing status, whether they are filing as a sole proprietor or a partnership.

7. Other pertinent information: Depending on the individual's specific circumstances, they may need to report additional information such as previous year's losses carried forward, goods and services tax/harmonized sales tax (GST/HST) collected, and more.

It's important to note that the specific requirements and sections of form 428 may vary depending on the province or territory in which the individual resides. It is recommended to consult the Canada Revenue Agency (CRA) website or seek professional advice to ensure accurate reporting.

When is the deadline to file form 428 in 2023?

The deadline to file form 428 in 2023 is generally April 30th. However, if you or your spouse or common-law partner are self-employed, the deadline is extended to June 15th. It is important to note that any balance owing must be paid by April 30th to avoid interest charges.

What is the penalty for the late filing of form 428?

Form 428 refers to the Canadian income tax form for calculating provincial or territorial tax. The specific penalty for late filing Form 428 may vary depending on the province or territory in which the taxpayer resides.

Generally, the penalty for late filing provincial or territorial tax returns can be a combination of the following:

1. Late filing penalty: This penalty is typically charged as a percentage of the tax owed and can range from 5% to 25%, depending on the province or territory.

2. Interest charges: Interest is usually applied daily on any amounts owing, including the late filing penalty, until the balance is paid in full. The interest rate can also vary depending on the province or territory.

It is important to note that the penalties and interest mentioned above are approximate and subject to change. It is recommended to consult the provincial or territorial tax authorities or a qualified tax professional for the most accurate and up-to-date information regarding the penalties for late filing Form 428.

How do I make edits in form 428 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing dd form 428 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my form 428 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your dd form 428 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out form 428 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your dd form 428, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your form 428 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.